Trump’s Tax Plan and How It Would Affect You

Senate Passes Tax Reform Bill with 51-49 Votes

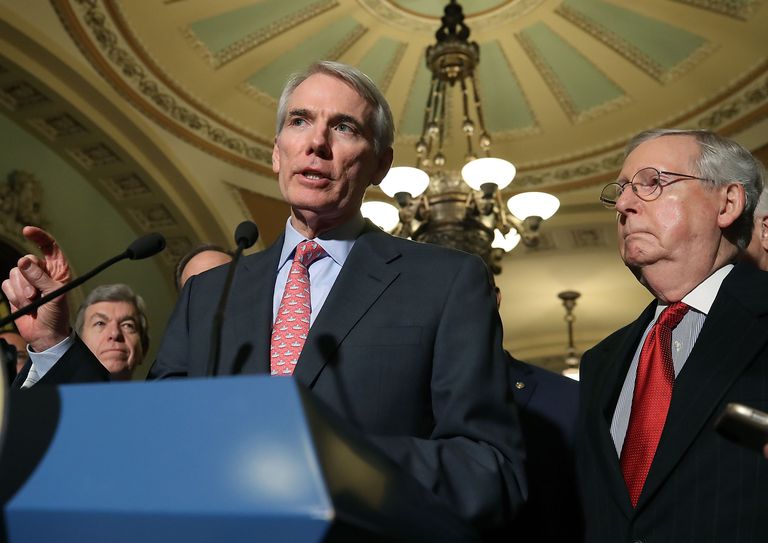

Sen. Rob Portman (R-OH) speaks to reporters about the proposed Senate Republican tax bill at US Capitol on November 14, 2017, in Washington, DC. Photo by Mark Wilson/Getty Images

How It Affects You

Dec 3, 2017 … By Kimberly Amadeo Updated December 02, 2017 On December 1, 2017, U.S. Senate passed its version of the Tax Cuts and

The Senate plan would help businesses more than individuals. The corporate tax cuts are permanent, while the individual cuts are not.

Among individuals, it would help higher-income families the most. Everyone gets a tax cut in 2019. But in 2021, taxes will increase on those making $30,000 or less. That’s because the deductions and credits they lose won’t make up for the lower tax rate. By 2023, costs will rise on everyone who makes less than $40,000 a year. The tax cuts expire in 2025. As a result, all income levels will pay higher taxes in 2027. That’s according to the most recent analysis of the Senate plan by the Joint Committee on Taxation.

The Tax Policy Center found that taxpayers earning in the top 1 percent would receive a larger percent tax cut than those in lower income levels. By 2027, those in the lowest 20 percent would pay higher taxes.

The Tax Policy Center estimated the House bill would impose higher taxes on 31 percent of middle-class households in 2027.

The increase in the standard deduction will benefit 6 million taxpayers. That’s 47.5 percent of all tax filers, according to Evercore ISI. But that’s not enough to offset lost deductions for many income brackets.

Neither plan helps the lowest-income families. That’s because more than 70 million Americans don’t make enough to pay taxes. The plans also don’t help the third of taxpayers who have incomes that fall below current standard deduction and personal exemptions, according to New York University law professor Lily Batchelder.

Both plans increase the deficit by almost $1.5 trillion over the next 10 years. The Joint Committee on Taxation reported that the bill would add $1 trillion even after including the tax cut’s impact on economic growth. It wouldn’t spur growth enough to offset the cuts’ loss in revenue.

The Penn Wharton School of Business said the House plan would increase the deficit by $2 trillion over its first 10 years. The Wharton estimate includes $500 billion in additional interest on the debt. It said the House plan would boost growth by 0.4 percent and 0.9 percent in its first 10 years. But it might not improve growth at all in the subsequent 10 years.

Budget-conscious Republicans have done an about-face. The party fought hard to pass sequestration. In 2011, some members even threatened to default on the debt rather than keep adding to it. Now they say that the tax cuts would boost the economy so much that the additional revenues would offset the tax cuts. They ignore the reasons why Reaganomics would not work today.

The impact on the $20 trillion national debt will eventually be higher than $1.5 trillion. Congressional leaders admit that the future Congress will probably extend the tax cuts.

Increase in sovereign debt dampens economic growth in the long run. When a country’s debt-to-GDP-ratio is more than 100 percent, investors get concerned. They demand higher yields on the nation’s bonds, increasing interest rates. Those higher rates slow growth.

The administration believes in supply-side economics. It says companies will use tax cuts to create jobs. It worked during the Reagan administration because the highest tax rate was 70 percent. According to the Laffer Curve, that’s in the prohibitive range. The range occurs at tax levels so high that cuts boost growth enough to offset the revenue loss. But trickle-down economics no longer works because the 2017 tax rates are half what they were in the 1980s.

Many large corporations confirmed they won’t use the tax cuts to create jobs. CEOs of Cisco, Pfizer, and Coca-Cola would instead use the extra cash to pay dividends to shareholders. The CEO of Amgen will use the proceeds to buy back shares of stock. In effect, the business tax cut will boost stock prices, but won’t create jobs.

The most significant tax cuts should go to the middle class who are more likely to spend every dollar they get. The wealthy use tax cuts to save or invest. It helps the stock market but doesn’t drive demand. Once demand is there, then businesses create jobs to meet it. Middle-class tax cuts create more jobs. But the best unemployment solution is government spending to build infrastructure and directly create jobs.

These increases to the debt could trigger an automatic cut in Medicare. The Pay-Go budget rule Congress must reduce spending on mandatory programs to offset tax cuts. The tax bill would force Congress to cut Medicare by $25 billion in 2018. In total, it would cut mandatory programs by $150 billion over the next 10 years. Congress usually waives Pay-Go when it passes each year’s budget.

The bill could help immigrants who were protected by Deferred Action for Childhood Arrivals. One of Trump’s immigration policies is to end the program in March 2018. Senator Jeff Flake, R-Ariz., got Senate leaders to agree to make the program permanent in exchange for his vote.